Mastering your finances is essential for achieving long-term success and peace of mind. One of the most effective ways to take control of your financial future is by setting clear financial goals. This article will guide you through the steps of setting financial goals step by step, ensuring that you can create a roadmap for your financial journey. Whether you’re saving for a new bike, planning for college, or dreaming of buying a house, having specific goals will help you manage your money effectively and reach your aspirations.

Key Takeaways

- Setting financial goals gives you direction and purpose for your money.

- Understanding your current financial situation is the first step in goal-setting.

- Clear and specific goals are easier to achieve than vague ones.

- Prioritizing your goals helps balance short-term needs with long-term dreams.

- Regularly reviewing and adjusting your financial plan keeps you on track.

Understanding the Basics of Financial Goals

Why Setting Goals Matters

Setting financial goals is like having a map for your money journey. It helps you know where you want to go and how to get there. When you have clear goals, you can make better choices about spending and saving. This way, you avoid buying things you don’t need and focus on what really matters to you.

Long-Term vs Short-Term Goals

Not all goals are the same. Some are big and take a long time to reach, like saving for college or buying a house. Others are smaller and quicker, like saving for a new phone. Here’s a quick look at both:

| Type of Goal | Example | Time Frame |

|---|---|---|

| Long-Term Goals | Saving for retirement | 10+ years |

| Short-Term Goals | Buying a new bike | Less than 1 year |

Both types are important. Long-term goals give you something big to aim for, while short-term goals keep you motivated along the way.

The Impact on Financial Health

Having financial goals can make a big difference in your life. They help you stay on track and avoid money problems. When you know what you want to achieve, it’s easier to make smart choices. This can lead to better financial health, less stress, and more freedom to do the things you love.

Taking the time to set financial goals gives you a sense of purpose and direction. It helps you overcome challenges and stay focused on what’s important.

Assessing Your Current Financial Situation

Before you can set any financial goals, you need to figure out your finances. This means taking an honest look at your entire financial situation — what you own and what you owe. This is a "net worth statement." On one side, list what you own.

Identifying Strengths and Weaknesses

Everyone has financial strengths and weaknesses. Maybe you’re great at saving but not so good at sticking to a budget. Or perhaps you have a lot of debt but also a high income. Identifying these can help you make a plan that works for you.

Evaluating Income and Expenses

Start by looking at all the money you have coming in and going out. Write down your income from jobs, bonuses, and any other sources. Then, list your monthly expenses like rent, groceries, and entertainment. Knowing where your money goes helps you see where you can save.

Setting a Baseline for Improvement

Your net worth is like a snapshot of your financial health. To find it, subtract what you owe from what you own. If you have more assets than debts, you’re in good shape. If not, you might need to make some changes.

Taking the time to assess your current financial situation is the first step toward achieving your financial goals. It might seem like a lot of work, but it’s worth it!

Defining Clear Financial Goals

Setting clear financial goals is like having a roadmap for your money. It helps you stay on track and reach your dreams. When you know exactly what you want to achieve, it’s easier to make smart choices with your money. Let’s dive into how you can set these goals and make them work for you.

Setting Specific Objectives

First, you need to be specific about what you want. Instead of saying, "I want to save money," say, "I want to save $1,000 in six months." This way, you have a clear target to aim for. Specific goals are easier to achieve because you know exactly what you’re working towards.

Aligning Goals with Personal Values

Your financial goals should match what’s important to you. If you value travel, set a goal to save for a vacation. If you care about education, plan to save for college. When your goals align with your values, you’re more likely to stick with them.

Examples of Common Financial Goals

Here are some common financial goals people set:

- Building an emergency fund

- Paying off debt

- Saving for retirement

- Buying a home

- Starting a business

Remember, the key to success is to be clear about what you want and to make a plan to get there. With the right goals, you can achieve anything you set your mind to.

Setting financial goals gives you a sense of purpose and direction. It helps you overcome challenges and stay focused on what’s important. A financial goal is any plan you have for your money.

Creating a Realistic Financial Plan

When it comes to managing your money, having a solid plan is key. A good financial plan helps you see where your money is going and how to save for the future. Here’s how to create one that works for you:

Budgeting for Success

Start by making a budget. This means listing all your income and expenses. Break them down into categories like rent, groceries, and fun stuff. A popular method is the 50-30-20 rule:

- 50% for needs (like bills and groceries)

- 30% for wants (like eating out)

- 20% for savings and paying off debt

This way, you can keep track of your spending and save for what matters.

Balancing Savings and Debt Repayment

It’s important to save while also paying off debt. Here’s a simple way to balance both:

- List all your debts and their interest rates.

- Focus on paying off high-interest debt first.

- Set aside a little for your emergency fund each month.

Using the 50-30-20 rule can help you manage this balance effectively.

Using Tools and Apps for Planning

There are many tools and apps that can help you manage your budget and savings. Some popular options include:

- Mint

- YNAB (You Need A Budget)

- Personal Capital

These tools can make budgeting easier and help you stay on track.

Remember, a financial plan is not set in stone. Life changes, and so should your plan. Be ready to adjust your budget and savings as needed.

By following these steps, you can create a financial plan that helps you reach your goals and stay on track. Don’t forget, financial planning basics include understanding your cash flow, savings, debt, and investments!

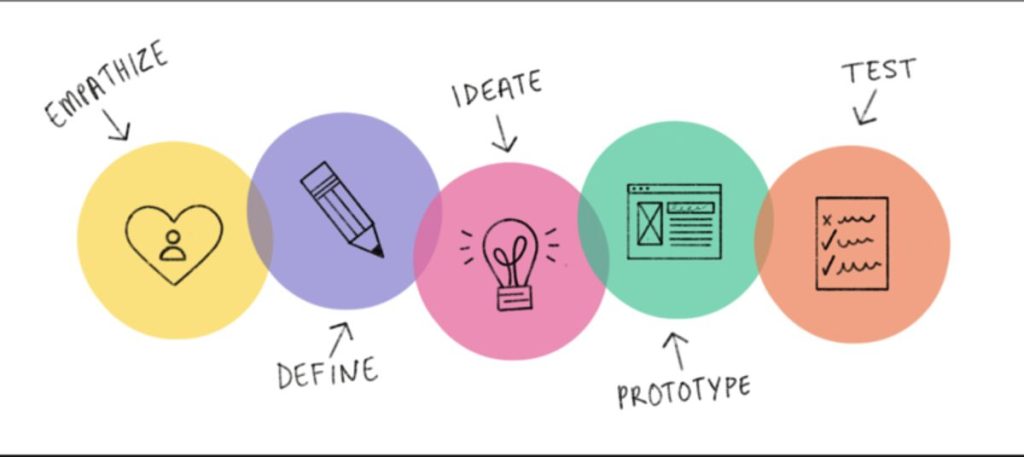

Implementing Your Financial Plan

Once you’ve set your financial goals and created a plan, it’s time to put that plan into action. This is where the rubber meets the road, and your efforts start to pay off. Taking action steps is crucial to making your financial dreams a reality. Break down your goals into smaller, manageable tasks and tackle them one by one. This approach makes the process less overwhelming and more achievable.

Taking Actionable Steps

- Start by listing out your financial goals.

- Break each goal into smaller tasks.

- Set deadlines for each task to keep yourself accountable.

Automating Savings and Investments

One of the best ways to ensure you stay on track is by automating your savings and investments. Set up automatic transfers from your checking account to your savings or investment accounts. This way, you won’t have to remember to do it manually, and you’ll be less tempted to spend the money elsewhere. Automating your finances can help you build wealth steadily over time.

Staying Motivated

Staying motivated is key to sticking with your financial plan. Celebrate small victories along the way to keep your spirits high. Whether it’s paying off a credit card or reaching a savings milestone, recognizing these achievements can boost your morale. Keep your eye on the prize and remind yourself why you set these goals in the first place. Staying consistent is essential for long-term success.

Remember, implementing your financial plan is a marathon, not a sprint. Stay patient and persistent, and you’ll see the results over time.

By following these steps, you can create a financial plan that helps you reach your goals and stay on track. A financial plan assesses your financial situation, considers your long-term goals, and makes a plan to reach them. Here’s how to create a financial plan.

Monitoring and Adjusting Your Plan

Tracking Your Progress

Keeping an eye on your financial plan is super important. Regularly check your income and expenses to see if you’re on track. This way, you can spot areas where you might be overspending or where you can save more. Tracking your progress helps you stay focused and make sure you’re moving towards your goals.

Making Necessary Adjustments

Sometimes, life happens, and things change. Maybe your goals shift, or your financial situation is different now. It’s okay to adjust your plan when needed. Being flexible and ready to change your plan can help you stay on the right path. Remember, it’s all about making sure your plan works for you.

Seeking Professional Advice

If you’re unsure about your plan or need some extra help, don’t hesitate to ask a professional. Financial advisors can give you tips and guidance to make sure you’re on the right track. They can help you with budgeting and saving strategies and make sure your plan is solid.

Staying flexible and open to change is key to achieving your financial goals. Don’t be afraid to adjust your plan as needed to keep moving forward.

Summary

Monitoring and adjusting your financial plan is essential for success. Here are some quick tips to keep in mind:

- Review your budget regularly to track your progress.

- Make adjustments as needed to ensure your plan aligns with your current situation.

- Seek help from professionals if you’re feeling stuck.

By following these steps, you can create a financial plan that helps you reach your goals and stay on track. Remember, monitoring and updating your plan at least annually will help you prioritize your decisions and track if the adjustments made are no longer necessary.

Overcoming Financial Challenges

Dealing with Setbacks

Setbacks are a normal part of any financial journey. Don’t let them bring you down! Instead, think of them as chances to learn. If you overspend one month, take a look at what happened and adjust your budget for the next month. Remember, it’s all about making progress, not being perfect.

Avoiding Financial Pitfalls

Financial pitfalls can easily derail your plans. Here are some common traps to watch out for:

- Impulse buying

- Not having an emergency fund

- Ignoring your budget

To avoid these, create a budget that includes a fun spending category and save at least three to six months’ worth of expenses for emergencies. This way, you can keep your finances on track.

Staying Consistent

Consistency is key to reaching your financial goals. It’s easy to start strong and then lose steam. To stay on track, consider setting up automatic transfers to your savings or investment accounts. This way, you won’t have to rely on willpower alone. Staying focused and adaptable is essential!

Overcome these challenges and reach your financial goals by staying focused and adaptable. It’s a journey worth taking!

Celebrating Your Financial Milestones

Recognizing Achievements

Celebrating your financial milestones is super important! Every achievement, big or small, deserves recognition. Whether you’ve saved your first $100 or paid off a credit card, each step is a victory. Here are some ways to celebrate:

- Share your success with friends or family.

- Treat yourself to something special, like a nice meal or a fun outing.

- Keep a journal of your achievements to look back on.

Rewarding Yourself

When you hit a financial goal, it’s time to reward yourself! This doesn’t have to be extravagant. Simple rewards can boost your motivation. Consider:

- A cozy movie night at home.

- A small shopping spree for something you’ve wanted.

- A day off to relax and recharge.

Reflecting on Your Journey

Taking time to reflect on your financial journey can help you understand what worked and what didn’t. Learning from your experiences is key to future success. Here’s how to reflect:

- Write down what strategies helped you achieve your goals.

- Think about any challenges you faced and how you overcame them.

- Set new goals based on your reflections to keep moving forward.

Remember, celebrating your milestones not only boosts your confidence but also keeps you motivated for the next steps in your financial journey. Each milestone is a building block towards your ultimate financial freedom!

Tips for Long-Term Financial Success

Regularly Reviewing Goals

To keep your financial journey on track, it’s important to check your goals often. Life changes, and so can your priorities. Make it a habit to review your financial goals every few months. This way, you can adjust them if needed and stay focused on what matters most to you.

Staying Informed and Educated

Knowledge is power! Stay updated on financial news and trends. Read books, follow blogs, or listen to podcasts about personal finance. The more you know, the better decisions you can make. Understanding how money works can help you avoid pitfalls and seize opportunities.

Building a Support System

Having a support system can make a big difference. Surround yourself with people who share your financial goals or who are financially savvy. This could be friends, family, or even online communities. They can offer advice, encouragement, and accountability as you work towards your financial success.

Remember, achieving financial success is a journey, not a race. Celebrate your progress and keep moving forward!

Summary Table of Tips

| Tip | Description |

|---|---|

| Regularly Reviewing Goals | Check and adjust your goals every few months. |

| Staying Informed and Educated | Keep learning about personal finance. |

| Building a Support System | Connect with others who share your financial goals. |

By following these tips, you can set yourself up for lasting financial success!

Wrapping It Up: Your Financial Journey Awaits

So there you have it! Mastering your finances is all about setting clear goals and sticking to them. Remember, it’s like planning a fun trip; you need to know where you’re headed and how to get there. Take it one step at a time, and don’t forget to celebrate your wins, no matter how small. With a little patience and effort, you’ll be well on your way to achieving your dreams. Keep your eyes on the prize, stay positive, and enjoy the journey to financial success!

Frequently Asked Questions

Why should I set financial goals?

Setting financial goals gives you a clear direction for your money. It helps you understand what you want to achieve and makes it easier to manage your spending and saving.

What’s the difference between long-term and short-term financial goals?

Long-term goals take time to reach, like saving for college or a house. Short-term goals are quicker, like saving for a new phone. Both are important for keeping you motivated.

How do financial goals affect my money health?

Having financial goals can improve your money management. They guide your spending choices, helping you avoid unnecessary purchases and focus on what matters.

How can I check my current financial situation?

Start by looking at your income and expenses. Identify your strengths and weaknesses to see where you can improve your financial health.

What are some examples of clear financial goals?

Examples include saving for a vacation, paying off debt, or building an emergency fund. Clear goals help you stay focused and motivated.

What tools can help me stick to my financial plan?

You can use budgeting apps, spreadsheets, or even simple pen and paper to track your spending and stay on budget.

How do I stay motivated while working towards my financial goals?

Celebrate small wins along the way, like paying off a credit card. Remind yourself why you set these goals to keep your spirits high.

What should I do if I face financial challenges?

If you hit a setback, analyze what went wrong and adjust your plan. Staying flexible and seeking help when needed can help you get back on track.