Planning for retirement is a vital step towards ensuring a comfortable and secure future. The earlier you begin, the better prepared you’ll be to enjoy your retirement years without financial stress. This article outlines the essential steps to help you start your retirement planning journey effectively.

Key Takeaways

- Begin your retirement planning as soon as possible to benefit from compound interest.

- Maximize your savings by contributing to retirement accounts like 401(k)s and IRAs.

- Regularly review and update your retirement plan to keep it aligned with your goals.

- Consider your desired lifestyle in retirement and adjust your finances to match.

- Prepare for increasing healthcare costs by including them in your retirement budget.

Understanding the Importance of Early Retirement Planning

Planning for retirement is super important, and starting early can make a big difference! The sooner you begin, the better your chances of enjoying a comfortable retirement. Here’s why it matters:

Benefits of Starting Early

- More Time to Save: The earlier you start saving, the more time your money has to grow.

- Less Stress: Starting early can help you avoid the panic of trying to save a lot in a short time.

- Financial Freedom: Early planning can lead to a more secure and enjoyable retirement.

Compound Interest and Its Impact

When you save money, it can earn interest. This is called compound interest, and it means you earn interest on your interest! Here’s a simple example:

| Years Saving | Amount Saved | Total with Interest |

|---|---|---|

| 10 | $1,000 | $1,500 |

| 20 | $1,000 | $3,000 |

| 30 | $1,000 | $6,000 |

As you can see, the longer you save, the more your money can grow!

Setting Realistic Goals

It’s important to set goals that you can actually achieve. Here are some tips:

- Think About Your Lifestyle: What do you want your retirement to look like?

- Calculate Your Needs: How much money will you need to live comfortably?

- Make a Plan: Write down your goals and how you plan to reach them.

Remember, by encouraging workers to start retirement planning early, employers can help improve their financial health and lessen financial stressors.

Starting your retirement planning now can lead to a brighter, more secure future!

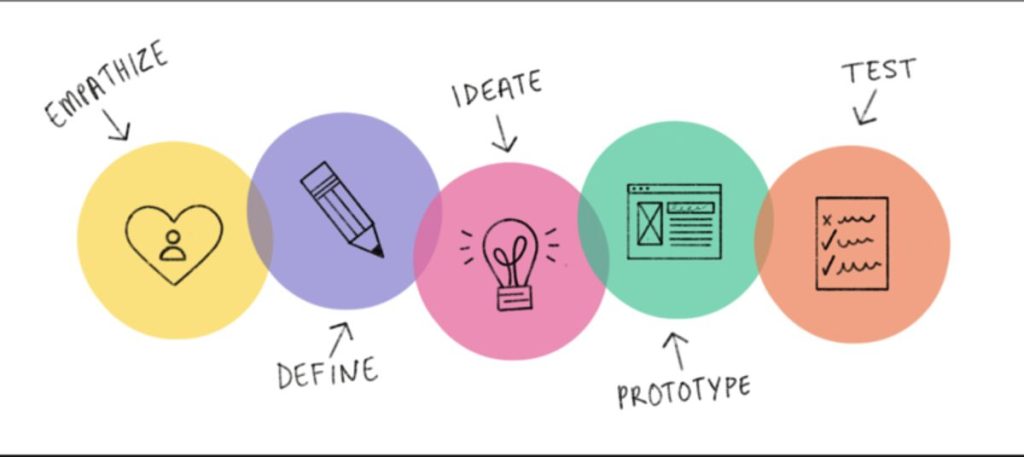

Creating a Personalized Retirement Savings Plan

When it comes to planning for your future, creating a personalized retirement savings plan is key. Starting early can make a huge difference! Here are some essential steps to help you get started:

Assessing Your Financial Situation

- Calculate your current expenses: Understand how much you spend each month.

- Estimate future costs: Think about how your expenses might change in retirement, including healthcare and leisure activities.

- Identify your income sources: Consider Social Security, pensions, and any other income you expect to have.

Choosing the Right Savings Accounts

- 401(k) Plans: If your employer offers one, make sure to enroll and contribute enough to get any matching funds.

- IRAs: Look into opening a Traditional or Roth IRA for additional tax benefits.

- High-Interest Savings Accounts: These can be great for short-term savings goals.

Setting a Contribution Schedule

- Start small: Even if you can only save a little, it adds up over time.

- Automate your savings: Set up automatic transfers to your retirement accounts to make saving easier.

- Increase contributions gradually: As you get raises or bonuses, consider putting more into your retirement savings.

Remember, the earlier you start saving, the more time your money has to grow. This can lead to a more comfortable retirement!

Maximizing Your Retirement Contributions

When it comes to saving for retirement, maximizing your contributions is key to building a secure future. The more you save now, the more you’ll have later! Here are some essential steps to help you boost your retirement savings:

Understanding Employer Matching

- If your employer offers a 401(k) plan, make sure to enroll and contribute enough to get the full employer match. This match is essentially free money added to your retirement savings.

- Increase your contributions gradually, especially when you receive raises or bonuses, to maximize your retirement fund.

- Remember, taking advantage of employer matching can significantly enhance your savings without extra effort on your part.

Exploring IRA and 401(k) Options

- In addition to your employer-sponsored plan, consider opening an Individual Retirement Account (IRA). Traditional IRAs offer tax-deferred growth, while Roth IRAs provide tax-free growth.

- For 2024, you can contribute up to $7,000 to a traditional or Roth IRA, or $8,000 if you’re 50 or older. This is a great way to catch up on your savings!

- Here’s a quick comparison of the two:

| Type of IRA | Tax Treatment | Contribution Limit (2024) | Age 50+ Catch-Up Contribution |

|---|---|---|---|

| Traditional IRA | Tax-deferred growth | $7,000 | $1,000 |

| Roth IRA | Tax-free growth | $7,000 | $1,000 |

Increasing Contributions Over Time

- Aim to save at least 15% of your pretax income each month. If that’s not possible right now, start with what you can and set goals to increase it over time.

- Automate your savings by setting up direct deposits into your retirement accounts. This way, you won’t be tempted to spend that money elsewhere.

- One great way to catch up is to contribute more to tax-advantaged plans, including individual retirement accounts (IRA) and workplace plans like a 401(k).

Remember, the earlier you start saving and the more you contribute, the better prepared you’ll be for a comfortable retirement. Don’t wait—your future self will thank you!

Diversifying Your Investment Portfolio

When it comes to investing, diversification is key. It means spreading your money across different types of investments to reduce risk. By doing this, you can protect yourself from market ups and downs. Here’s how to get started:

Balancing Risk and Reward

- Stocks: These can offer high returns but come with higher risks.

- Bonds: Generally safer, they provide lower returns but help stabilize your portfolio.

- Real Estate: This can give you steady income and potential value growth.

Exploring Different Investment Options

Consider these options for a well-rounded portfolio:

- Mutual Funds: These are a mix of stocks and bonds managed by professionals.

- Robo-Advisors: Automated services that help manage your investments at a low cost.

- ETFs: Exchange-traded funds that can be a cost-effective way to invest in a variety of assets.

Regularly Reviewing Your Portfolio

It’s important to check your investments regularly. Here’s a simple plan:

- Set a schedule: Review your portfolio at least once a year.

- Adjust as needed: If one investment is doing poorly, consider shifting funds to a better-performing one.

- Stay informed: Keep up with market trends and news that could affect your investments.

Remember, portfolio diversification is creating synergy between different types of investments — such as stocks, bonds, and real estate — in one’s portfolio. This strategy helps you manage risk and can lead to better long-term returns.

Planning for Healthcare Costs in Retirement

As you think about retirement, don’t forget to plan for healthcare costs! Medical expenses can be one of the biggest challenges for many retirees. Here’s how to get ready:

Understanding Medicare and Supplemental Insurance

- Medicare is a government program that helps cover some healthcare costs, but it doesn’t cover everything.

- Many people choose to get extra coverage through Medicare Advantage or Medigap plans to help with additional costs.

- It’s smart to start looking into your options well before you retire.

Budgeting for Healthcare Expenses

- Set aside extra savings specifically for healthcare needs.

- Consider how much you might spend on medications, doctor visits, and other health-related expenses.

- A good rule of thumb is to aim for about 15% of your retirement budget to go towards healthcare.

Considering Long-Term Care Insurance

- Long-term care can be very expensive, whether it’s in-home care or a nursing home.

- Look into long-term care insurance to help cover these costs, especially if you’re planning to retire soon.

- This insurance can protect your savings from being drained by high healthcare costs.

Planning for healthcare costs is essential for a secure retirement. By preparing now, you can enjoy your golden years without financial stress.

Estimating Your Retirement Income Needs

When it comes to planning for retirement, one of the most important steps is figuring out how much money you’ll need. Your retirement income needs can vary greatly depending on your lifestyle and expenses. Here are some key points to consider:

Calculating Future Expenses

To get a good idea of how much you’ll need, start by estimating your future expenses. Think about:

- Housing costs (rent or mortgage)

- Healthcare expenses

- Daily living costs (food, clothing, transportation)

- Entertainment and hobbies

Creating a budget can help you visualize these costs. You might want to aim for about 70% to 90% of your pre-retirement income. For example, if you currently earn $63,000 a year, you might need between $44,000 and $57,000 annually in retirement.

Considering Inflation and Lifestyle Changes

Inflation can impact your purchasing power over time. It’s wise to factor in an annual increase in costs. Additionally, your lifestyle may change in retirement. You might want to travel more or pick up new hobbies, which can increase your expenses.

Planning for Unexpected Costs

Life is unpredictable, and unexpected expenses can arise. It’s a good idea to set aside some savings for emergencies. This way, you can enjoy your retirement without financial stress.

Remember, estimating your retirement income needs is a crucial step in ensuring a comfortable future. By planning ahead, you can avoid surprises and enjoy your golden years.

In summary, understanding how much you need for retirement involves careful planning and consideration of various factors. By taking the time to estimate your future expenses, you can set yourself up for a secure and enjoyable retirement.

For a rough estimate, consider the rule of thumb: you might need around $1.25 million if you expect to withdraw about $50,000 a year. This is based on the 4% rule, which suggests that you can withdraw 4% of your retirement savings each year without running out of money.

Understanding Social Security Benefits

Social Security is a vital part of retirement planning. It provides a foundation of income for many retirees. Social Security retirement benefits are for workers 62 and older who have earned at least 40 credits. The amount you receive depends on your average earnings during your working years.

When to Start Claiming Benefits

- The earliest you can start claiming Social Security benefits is age 62.

- If you claim early, your benefits will be reduced.

- Full retirement age is 67 for those born in 1960 or later, and delaying benefits until age 70 can increase your monthly payment.

Maximizing Your Social Security Income

To get the most out of your Social Security benefits:

- Understand your benefits: Use the Social Security Administration’s online calculator to estimate your monthly payment.

- Consider your claiming strategy: Think about when it makes sense for you to start claiming benefits based on your financial situation.

- Consult a financial advisor: They can help you navigate the complexities of Social Security and maximize your income.

Consulting a Financial Advisor

Getting professional advice can be beneficial. A financial advisor can:

- Help you understand your Social Security benefits better.

- Provide personalized strategies for your retirement income.

- Keep you informed about any changes in Social Security regulations.

Remember, planning for Social Security is just one piece of your retirement puzzle. Make sure to consider all your income sources for a secure future!

The Role of Tax Planning in Retirement

When it comes to planning for retirement, understanding taxes is super important. Taxes can really affect how much money you have during your retirement years. By managing your tax obligations wisely, you can keep more of your savings and enjoy a more comfortable retirement.

Utilizing Tax-Advantaged Accounts

- 401(k)s: These accounts let you save money before taxes are taken out, which can lower your taxable income now.

- IRAs: Individual Retirement Accounts also offer tax benefits, either by deferring taxes until withdrawal or allowing tax-free growth.

- Roth IRAs: With these, you pay taxes upfront, but your withdrawals in retirement are tax-free.

Understanding Tax Implications

It’s crucial to know how different types of income are taxed during retirement:

- Income Tax: Most of your retirement income, like pensions and Social Security, may be taxed.

- Capital Gains Tax: If you sell investments for a profit, you might owe taxes on those gains.

- Estate Tax: This tax applies to your assets after you pass away, so planning ahead can help your beneficiaries.

| Type of Tax | Description |

|---|---|

| Income Tax | Tax on your earnings during retirement |

| Capital Gains Tax | Tax on profits from selling investments |

| Estate Tax | Tax on your estate after death |

Remember, planning for taxes is a key part of your retirement strategy. It helps you keep more of your hard-earned savings and enjoy your retirement without financial stress.

Strategies for Minimizing Tax Liability

- Start Early: The sooner you begin saving in tax-advantaged accounts, the better.

- Consult a Professional: A financial advisor can help you navigate complex tax laws and find the best strategies for your situation.

- Stay Informed: Keep up with changes in tax laws that could affect your retirement planning.

By incorporating tax planning into your retirement strategy, you can maximize your savings and ensure a secure financial future. Don’t overlook this important aspect of your retirement planning!

Regularly Reviewing and Adjusting Your Retirement Plan

Retirement planning isn’t a one-and-done deal. It’s important to check in on your plan regularly to make sure you’re still on track. Life can throw curveballs, and your financial goals might change, so being flexible is key!

Adapting to Life Changes

- Major life events like getting married, having kids, or changing jobs can affect your retirement savings.

- If your income changes, you might need to adjust how much you save.

- Keep an eye on your spending habits and see if you can save more.

Monitoring Investment Performance

- Check how your investments are doing at least once a year.

- If something isn’t working, don’t be afraid to switch things up!

- Use tools like retirement calculators to see if you’re on track to meet your goals.

Staying Informed on Financial Regulations

- Tax laws and retirement rules can change, so stay updated!

- Understanding new regulations can help you take advantage of benefits or avoid penalties.

- Consider consulting a financial advisor for personalized advice.

Remember, adjusting your retirement plan is a sign of being proactive, not reactive. Stay engaged with your finances to ensure a secure future!

Envisioning Your Retirement Lifestyle

Thinking about your retirement lifestyle is super important! It’s all about creating a vision for your future. Here are some things to consider:

Deciding When to Retire

- Think about the age you want to retire.

- Consider if you want to retire early, at the usual age, or even later.

- Reflect on how your job affects your retirement plans.

Planning for Travel and Leisure

- Make a list of places you want to visit.

- Think about hobbies you want to pursue, like painting or gardening.

- Set aside a budget for fun activities and adventures.

Considering Part-Time Work or New Ventures

- Explore options for part-time work if you want to stay active.

- Think about starting a small business or consulting.

- Consider volunteering or taking classes to learn new skills.

Remember, envisioning your retirement is about more than just finances; it’s about creating a fulfilling life. By planning ahead, you can enjoy your golden years without financial worries.

In summary, envisioning your retirement lifestyle helps you set clear goals and prepare for a future that aligns with your dreams. Start thinking about what you want, and take steps to make it happen!

Seeking Professional Financial Advice

When it comes to planning for retirement, getting help from a professional can make a big difference. A financial advisor can guide you through the complex world of retirement planning. They can help you create a plan that fits your unique needs and goals.

Benefits of Consulting a Financial Planner

- Personalized Advice: A financial planner can give you tailored advice based on your financial situation.

- Expert Knowledge: They understand the ins and outs of retirement accounts and investment options.

- Tax Strategies: Advisors can help you navigate tax implications and find ways to save more.

Finding the Right Advisor for You

To find a financial advisor, get recommendations from people you trust, ask for references, and interview possible candidates. Here are some tips:

- Check Credentials: Look for certifications like CFP (Certified Financial Planner).

- Understand Fees: Make sure you know how they charge for their services.

- Ask Questions: Don’t hesitate to ask about their experience and approach to retirement planning.

Staying Educated and Informed

Even after hiring an advisor, it’s important to stay involved in your financial planning. Regularly review your retirement plan and ask questions if something isn’t clear. This way, you can ensure your plan stays on track and meets your needs.

Remember, seeking professional advice is a smart step towards a secure retirement. It can help you feel more confident about your financial future!

Wrapping It Up: Your Path to a Happy Retirement

Planning for retirement might feel like a big job, but it’s totally manageable if you take it step by step. Starting early, saving regularly, and making smart choices can really help you enjoy a cozy and secure future. Remember, it’s never too late to begin! Whether you’re just starting your career or thinking about retirement soon, taking action now will make a difference later. So, relax, make a plan, and get excited about your golden years without money worries!

Frequently Asked Questions

When is the best time to start planning for retirement?

It’s a good idea to start planning for retirement as soon as you begin your job. The earlier you start, the more your money can grow.

How much should I save for retirement each year?

A common suggestion is to save at least 15% of your income each year. However, this amount can change based on your lifestyle and retirement dreams.

What are some ways to save for retirement?

You can save for retirement using accounts like a 401(k) or an IRA. These accounts can help your money grow over time.

How can I make sure I have enough money for healthcare in retirement?

It’s important to plan for healthcare costs, as they can increase as you age. Consider setting aside extra savings and looking into insurance options.

What should I consider when estimating my retirement income needs?

Think about your future expenses, how inflation might affect costs, and any unexpected expenses that could arise.

When should I start taking Social Security benefits?

You can start taking Social Security benefits at age 62, but waiting until you’re older can increase your monthly benefit.

How can I reduce taxes on my retirement savings?

Using tax-advantaged accounts like IRAs and 401(k)s can help reduce your taxes. It’s also helpful to consult with a tax professional.

Why is it important to review my retirement plan regularly?

Regular reviews help you adjust your plan based on life changes, market conditions, and your financial goals to stay on track.