Managing your money can feel overwhelming, especially if you’re just starting out. However, learning how to budget is an essential skill that can help you take control of your finances and work towards your financial goals. In this article, we’ll explore some essential budgeting tips for beginners that will make it easier for you to track your spending, save money, and build a secure financial future.

Key Takeaways

- Start by creating a simple budget that includes all your income and expenses.

- Always separate your needs from your wants to make better spending choices.

- Use budgeting apps or tools to track your spending and stay organized.

- Set specific financial goals to keep yourself motivated and focused.

- Review and adjust your budget regularly to reflect changes in your financial situation.

Understanding the Basics of Budgeting

What is Budgeting?

Budgeting is simply a plan for your money. It helps you see how much you earn and how much you spend. By creating a budget, you can control your finances better. It’s like having a map for your money journey!

Why Budgeting is Important

Budgeting is crucial because it helps you:

- Track your spending

- Save for future goals

- Avoid debt

- Understand your financial habits

When you know where your money goes, you can make smarter choices. Budgeting gives you peace of mind and helps you feel in control of your finances.

Common Budgeting Myths

There are many myths about budgeting that can hold you back:

- Budgeting is too hard. – It can be simple if you start small.

- You can’t have fun while budgeting. – You can still enjoy life by planning for fun expenses!

- Budgets are only for people in debt. – Everyone can benefit from budgeting, even if you’re saving!

Remember, budgeting isn’t about restricting yourself; it’s about making your money work for you!

Setting Clear Financial Goals

Setting financial goals is like having a map for your money journey. It helps you know where you’re going and how to get there. Whether you’re saving for a new bike, college, or a house, having clear goals makes it easier to manage your money. Here’s how to set those goals and make them work for you.

Short-term vs Long-term Goals

First, let’s talk about the difference between short-term and long-term goals. Short-term goals are things you want to achieve soon, like saving for a new phone or paying off a small debt. Long-term goals, like saving for a house or retirement, take more time but are just as important. Here’s a quick list of examples:

- Short-term goals: Saving for a vacation, buying a new gadget, or paying off a credit card.

- Long-term goals: Saving for college, buying a home, or planning for retirement.

How to Prioritize Your Goals

Once you have your goals, it’s time to prioritize them. Ask yourself:

- Which goals are most important right now?

- Which goals will have the biggest impact on my life?

- How much time and money do I need for each goal?

This will help you focus on what matters most and keep you motivated.

Tracking Your Progress

Tracking your progress is key to staying on track. You can use a simple table to see how you’re doing:

| Goal | Target Amount | Amount Saved | Remaining Amount |

|---|---|---|---|

| Emergency Fund | $1,000 | $300 | $700 |

| Vacation | $500 | $200 | $300 |

| New Laptop | $800 | $400 | $400 |

Remember, tracking your progress helps you celebrate small wins and stay motivated!

Setting clear financial goals gives you a sense of purpose and direction. It helps you overcome challenges and stay focused on what’s important.

By following these steps, you can create a solid plan to reach your financial goals and enjoy the journey along the way!

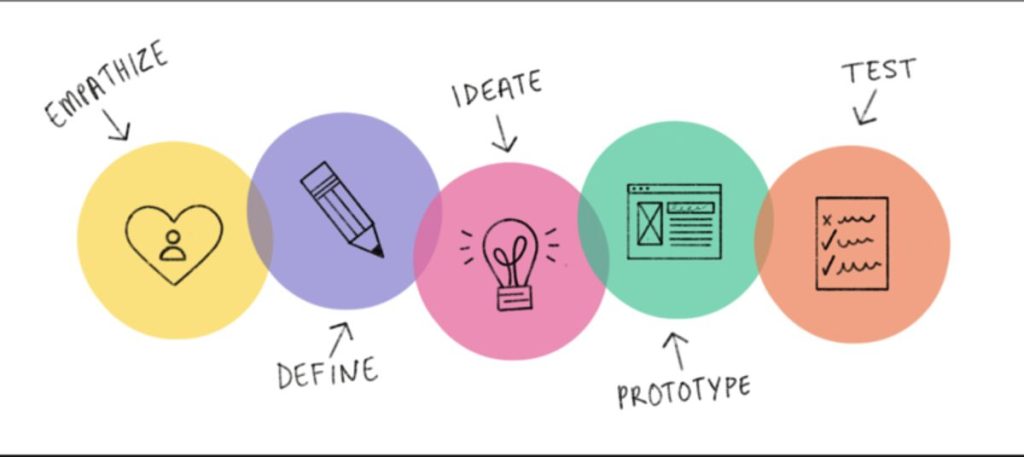

Choosing the Right Budgeting Method

When it comes to budgeting, finding a method that suits your lifestyle is key. Here are some popular methods to consider:

Zero-based Budgeting Explained

This method requires you to assign every dollar you earn a specific purpose. At the end of the month, your budget should equal zero. This means every dollar has a job! It’s great for those who want to track their spending closely.

The 50/30/20 Rule

This simple rule suggests you allocate:

- 50% of your income to needs (like rent and groceries)

- 30% to wants (like dining out and entertainment)

- 20% to savings and debt repayment

This method is flexible and easy to follow, making it perfect for beginners.

Envelope System Basics

In this method, you use cash for different spending categories. You put cash in envelopes labeled for each category (like groceries, entertainment, etc.). When the cash is gone, you can’t spend any more in that category. This can help you stick to your budget and avoid overspending.

Remember, the best budgeting method is the one that fits your personal style and helps you stay on track. Experiment with different methods until you find the one that works for you!

Tracking Your Income and Expenses

Keeping an eye on your money is super important for managing your finances. Tracking your income and expenses helps you understand where your money goes each month. Here are some tips to make it easier:

Tools for Tracking Expenses

- Budgeting Apps: Use apps like Mint or YNAB to track your spending.

- Spreadsheets: Create a simple spreadsheet to log your income and expenses.

- Notebook: If you prefer pen and paper, jot down your expenses in a notebook.

Categorizing Your Spending

To get a clear picture of your finances, categorize your spending into:

- Fixed Expenses: These are regular payments like rent and utilities.

- Variable Expenses: These include groceries, entertainment, and other flexible costs.

- Savings: Always set aside a portion for savings!

Adjusting Your Budget Regularly

It’s important to review your budget often. Here’s how:

- Weekly Check-ins: Look at your spending weekly to stay on track.

- Monthly Reviews: Adjust your budget based on your spending habits.

- Set Goals: Make sure your budget aligns with your financial goals.

Remember, tracking your expenses is the first step towards financial stability. By knowing where your money goes, you can make better decisions and avoid overspending.

By following these steps, you can take control of your finances and work towards achieving your financial goals. Don’t forget to check your account statements regularly to see how you’re doing!

Distinguishing Between Needs and Wants

Understanding the difference between needs and wants is crucial for effective budgeting. Needs are essential for your basic survival, while wants are non-essential items that enhance your lifestyle. Here’s how to break it down:

Identifying Essential Expenses

- Housing: Rent or mortgage payments.

- Food: Groceries necessary for daily meals.

- Utilities: Electricity, water, and heating costs.

Cutting Back on Non-Essentials

- Dining Out: Consider cooking at home more often.

- Subscriptions: Cancel those you rarely use.

- Luxury Items: Delay purchases of non-essential items.

Finding a Balance

- Create a list of your needs and wants.

- Allocate your budget to cover needs first, then wants.

- Regularly review your spending to ensure you’re sticking to your priorities.

Remember, when budgeting and controlling your spending, it’s essential to distinguish between needs vs wants. This clarity will help you make better financial decisions and avoid unnecessary debt.

Building an Emergency Fund

An emergency fund is a vital part of your financial plan. It acts as a safety net for those unexpected costs that life throws your way, like car repairs or medical bills. Aiming to save at least three to six months’ worth of living expenses is a great goal. Even if you can only save a little at first, every bit counts!

Why You Need an Emergency Fund

Having an emergency fund gives you peace of mind. It means you won’t have to rely on credit cards or loans when something unexpected happens. Here are some reasons why you should start building your fund:

- Financial security: You’ll feel more secure knowing you have money set aside.

- Avoiding debt: You can cover emergencies without going into debt.

- Stress reduction: Knowing you’re prepared can lower your stress levels.

How Much to Save

To figure out how much you should save, start by looking at your monthly expenses. Here’s a simple way to break it down:

| Expense Type | Monthly Amount |

|---|---|

| Rent/Mortgage | $XXXX |

| Utilities | $XXXX |

| Groceries | $XXXX |

| Transportation | $XXXX |

| Other Expenses | $XXXX |

| Total | $XXXX |

Once you have your total, multiply it by three to six to find your emergency fund goal.

Tips for Growing Your Fund

- Start small: Even saving $10 a week can add up over time.

- Automate your savings: Set up automatic transfers to your savings account so you don’t have to think about it.

- Use windfalls wisely: If you get a bonus or tax refund, consider putting that money directly into your emergency fund.

Building an emergency fund is a marathon, not a sprint. Stay patient and persistent, and you’ll reach your goal.

By following these steps, you can create a solid emergency fund that will help you handle life’s surprises without stress!

Using Technology to Simplify Budgeting

In today’s world, technology can be your best friend when it comes to budgeting. Using the right tools can make managing your finances a breeze! Here are some ways technology can help:

Top Budgeting Apps

- Mint: This app helps you track your spending and set budgets.

- YNAB (You Need A Budget): Focuses on helping you allocate every dollar you earn.

- EveryDollar: A simple app for creating a budget and tracking expenses.

Benefits of Digital Tools

- They provide a clear view of your financial health.

- Many apps offer AI-driven budgeting solutions to save time and money.

- You can sync your budget with your partner, making it easier to manage shared expenses.

Syncing Budgets with Partners

- Communication: Keep each other informed about spending.

- Shared Goals: Work together towards common financial goals.

- Accountability: Help each other stick to the budget.

Embracing technology can transform budgeting from a chore into a habit. With the right tools, you can take control of your finances and enjoy the journey!

Avoiding Common Budgeting Mistakes

When it comes to budgeting, many beginners stumble over a few common pitfalls. Here’s how to avoid these top 3 common budgeting mistakes:

1. Setting Unrealistic Expectations

Many people start budgeting with high hopes but end up feeling disappointed. It’s important to set goals that are achievable. Instead of aiming to save 50% of your income right away, start with a smaller percentage and gradually increase it as you get comfortable.

2. Not Accounting for Irregular Expenses

Another mistake is forgetting about those unexpected costs that pop up throughout the year, like car repairs or medical bills. To avoid this, create a separate category in your budget for these irregular expenses. This way, you won’t be caught off guard when they arise.

3. Failing to Track Your Spending

Tracking your spending is crucial for staying on budget. If you don’t know where your money is going, it’s easy to overspend. Use apps or simple spreadsheets to keep an eye on your expenses. Regularly reviewing your spending can help you make necessary adjustments.

Remember, budgeting is a journey, not a race. It’s okay to make mistakes as long as you learn from them and keep moving forward!

Staying Motivated and Consistent

Celebrating Small Wins

Recognizing your achievements is key! Celebrate every little victory, whether it’s paying off a small debt or reaching a savings goal. These moments of success can boost your motivation and keep you on track.

Accountability Partners

Having someone to share your journey with can make a big difference. Find a friend or family member who can be your accountability partner. You can check in with each other regularly to discuss your progress and challenges.

Rewarding Yourself Wisely

It’s important to treat yourself occasionally! Set aside a small portion of your budget for fun activities or treats. This way, you can enjoy life while still sticking to your financial goals. Here are some ideas:

- A nice dinner out

- A movie night with friends

- A small shopping spree

Staying consistent with your budget doesn’t mean you can’t have fun. It’s all about finding a balance that works for you!

Prioritizing Savings and Investments

Paying Yourself First

Make saving a priority! Treat your savings like a bill that must be paid each month. Here’s how to do it:

- Set a specific percentage of your income to save before spending on anything else.

- Automate your savings by setting up automatic transfers to your savings account.

- Track your savings progress to stay motivated and adjust as needed.

Retirement Savings Tips

Starting to save for retirement early can make a big difference. Here are some tips:

- Open a retirement account like a 401(k) or IRA.

- Contribute enough to get any employer match, as it’s free money!

- Increase your contributions whenever you get a raise.

Investment Basics for Beginners

Investing can help your money grow over time. Here are some simple steps to get started:

- Learn about different investment options like stocks, bonds, and mutual funds.

- Start small and gradually increase your investments as you learn more.

- Diversify your portfolio to spread out risk and increase potential returns.

Remember, the earlier you start saving and investing, the more time your money has to grow. Don’t wait—your future self will thank you!

Managing Debt Effectively

Managing debt can feel overwhelming, but with the right strategies, you can take control and work towards a debt-free life. Here’s how to do it:

Understanding Different Types of Debt

Debt comes in various forms, and knowing what you owe is the first step to managing it. Here are some common types:

- Credit Card Debt: Often has high interest rates.

- Student Loans: Can be federal or private, with different repayment options.

- Personal Loans: Usually unsecured and can vary in terms.

Strategies for Debt Repayment

To tackle your debt effectively, consider these strategies:

- Debt Snowball Method: Pay off the smallest debts first to gain momentum.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first to save money.

- Consolidation: Combine multiple debts into one loan with a lower interest rate.

Avoiding Debt Traps

Staying out of debt is just as important as paying it off. Here are some tips:

- Live Within Your Means: Stick to your budget and avoid unnecessary expenses.

- Use Credit Wisely: Only charge what you can afford to pay off each month.

- Emergency Fund: Build a small fund to cover unexpected expenses, so you don’t rely on credit.

Remember, managing debt is a journey, not a sprint. Celebrate small victories along the way, and stay focused on your goals!

Planning for Fun and Leisure

Budgeting isn’t just about paying bills and saving for the future; it’s also about enjoying life! Including fun in your budget is essential for a balanced financial plan. Here’s how to make room for leisure activities without breaking the bank.

Budgeting for Entertainment

- Set a Fun Budget: Decide how much money you can spend on entertainment each month. This could include dining out, movies, or hobbies.

- Plan Ahead: Look for deals or discounts on activities you enjoy. Planning can help you save money while still having fun.

- Explore Free Options: Check out local events, parks, or community activities that are free or low-cost.

Saving for Vacations

- Create a Vacation Fund: Set aside a small amount each month specifically for travel. This way, you can enjoy a trip without feeling guilty about spending.

- Research Affordable Destinations: Look for places that fit your budget. Sometimes, a nearby location can be just as fun as a faraway destination.

- Travel Off-Peak: If possible, plan your trips during off-peak seasons to save money on flights and accommodations.

Balancing Fun and Finances

- Prioritize Your Spending: Make a list of what brings you joy and allocate funds accordingly. This helps you enjoy your favorite activities without overspending.

- Avoid Impulse Buys: Stick to your budget and avoid spontaneous purchases that can derail your financial goals.

- Review Regularly: Check your budget often to see if you can adjust your fun spending based on your financial situation.

Remember, budgeting is about balance. You can enjoy life while still being financially responsible. By planning for fun, you ensure that your budget supports both your needs and your desires.

Wrapping It Up: Your Path to Financial Freedom

Getting your finances in order doesn’t have to feel overwhelming. By using these budgeting tips, you can start to see real changes in how you manage your money. Remember, the goal is to make your money work for you. Take it one step at a time, stay on track, and don’t be too hard on yourself if you make mistakes. Every little effort counts towards your financial success. Keep adjusting your budget as your needs change, and soon, you’ll find yourself in a much better spot financially. Happy budgeting!

Frequently Asked Questions

What is the purpose of having a budget?

A budget helps you manage your money better. It shows you how much you can spend and saves you from running out of money.

What does it mean to budget to zero?

Budgeting to zero means planning where every dollar you earn will go, so at the end of the month, you have no money left over.

What tools can I use to help with budgeting?

You can use apps, spreadsheets, or online calculators to help you keep track of your spending and manage your budget.

How can I tell the difference between needs and wants?

Needs are essential things you must have, like food and shelter. Wants are things you would like but can live without, like new clothes or eating out.

Why is it important to keep my bills and receipts organized?

Keeping your bills and receipts organized helps you track your spending and ensures you pay your bills on time, avoiding late fees.

How should I prioritize paying off debt?

Focus on paying off debts with the highest interest rates first to save money over time.

How can I stay motivated to stick to my budget?

Celebrate small achievements, find an accountability partner, and reward yourself wisely to stay motivated.

What should I do if I find it hard to stick to my budget?

If sticking to your budget is tough, adjust it to be more realistic and flexible, and remember that it’s okay to make changes.