Debt can feel overwhelming, but there are simple ways to tackle it. This guide will help you understand your debt, create a budget, and find effective strategies to pay it off. With the right approach, you can achieve financial freedom and live a stress-free life.

Key Takeaways

- Knowing your total debt is the first step to creating a payment plan.

- A good budget helps you manage your money and pay off debt faster.

- Select a debt repayment method that works best for you.

- Paying more than the minimum can help you get out of debt quicker.

- Cutting back on unnecessary spending can free up cash for debt payments.

Understanding Your Debt Situation

Before you can tackle your debt, it’s important to understand what you’re dealing with. Knowing your debt situation is the first step towards financial freedom! Here’s how to get started:

Know What You Owe

Start by making a list of all your debts. Include the total amount owed, the interest rates, and the minimum monthly payments. This will help you see the full picture of your financial obligations.

Assess Your Interest Rates

Next, look at the interest rates on your debts. High-interest debts can cost you a lot more over time. Prioritize paying these off first to save money in the long run.

Identify Your Debt Types

Understanding the types of debt you have is crucial. Here are some common types:

- Credit Card Debt: Usually has high interest rates.

- Student Loans: Often have lower interest rates but can be a large amount.

- Personal Loans: Can vary in interest rates and terms.

Remember, understanding your debt is the first step to creating a plan to pay it off. It’s all about taking control of your financial future!

Creating a Realistic Budget

Building a budget is your guide to managing your money and the foundation of any debt reduction plan. It helps you see where your money is going and where you can make changes to free up cash for debt repayment. Follow this guide to learn how to budget money effectively and take control of your finances.

Track Your Income and Expenses

To get started, you need to know where your money is going. Write down all your sources of income and every expense you have. This includes rent, groceries, and even that daily coffee. Tracking your income and expenses helps you see where you can cut back.

Set Financial Goals

Once you know your spending habits, set some financial goals. Do you want to pay off a certain amount of your loan this year? Or maybe save for a vacation? Having clear goals will keep you motivated.

Adjust Your Spending Habits

Now that you have your goals, look at your spending. Are there areas where you can spend less? Maybe cook at home more often or cancel a subscription you don’t use. Small changes can make a big difference in your budget.

- Evaluate your monthly subscriptions.

- Reduce utility bills by being more energy-efficient.

- Cook at home more often instead of dining out.

A smart budget, personalized to your income and other expenses, can be your greatest asset in paying off your student loans while maintaining your quality of life.

By following these steps, you can create a financial plan that helps you reach your goals and stay on track. Remember, budgeting isn’t just about cutting back; it’s about making your money work for you!

Choosing the Right Debt Reduction Strategy

When it comes to tackling debt, picking the right strategy can make a big difference. Here are some popular methods to consider:

Debt Avalanche Method

This method focuses on paying off debts with the highest interest rates first. By doing this, you can save money on interest over time. Here’s how it works:

- List your debts from highest to lowest interest rate.

- Make minimum payments on all debts except the one with the highest interest.

- Put any extra money towards the highest interest debt until it’s paid off.

- Move on to the next highest interest debt and repeat.

Debt Snowball Method

The debt snowball method is all about quick wins. You pay off your smallest debts first to build momentum. Here’s how:

- List your debts from smallest to largest.

- Make minimum payments on all debts except the smallest one.

- Put any extra money towards the smallest debt until it’s gone.

- Move on to the next smallest debt and repeat.

Debt Consolidation Options

If you have multiple debts, consolidating them into one loan can simplify your payments. Here are some options:

- Personal loans: These can help combine high-interest debts into one lower-interest loan.

- Balance transfer credit cards: These allow you to transfer high-interest credit card debt to a card with a lower rate.

- Home equity loans: If you own a home, you might be able to use its equity to secure a loan with a lower interest rate.

Remember, choosing the right strategy is key to your success. Take the time to evaluate your situation and pick the method that feels right for you.

Understanding your options can help you find the best path to financial freedom. Whether you choose the debt avalanche for savings or the snowball for motivation, every step counts!

Making Extra Payments to Reduce Debt

Benefits of Paying More Than the Minimum

Making extra payments on your debt can really help you get ahead. By paying more than the minimum, you reduce the principal balance faster, which means you pay less interest over time. For example, if you owe $10,000 at a 4.5% interest rate and pay an extra $100 each month, you could be debt-free about five and a half years earlier! Here’s a quick look at how extra payments can impact your debt:

| Debt Amount | Interest Rate | Extra Payment | Time Saved |

|---|---|---|---|

| $10,000 | 4.5% | $100 | 5.5 years |

| $5,000 | 6% | $50 | 2 years |

| $15,000 | 5% | $150 | 7 years |

How to Find Extra Money for Payments

Finding extra cash for payments can be easier than you think! Here are some ideas:

- Sell unused items: Look around your home for things you no longer need. Selling them can give you a nice boost.

- Take on a side hustle: Consider part-time jobs like dog walking or freelancing. Every little bit helps!

- Cut back on non-essentials: Maybe skip that daily coffee or eat out less. Put those savings toward your debt.

Automating Extra Payments

Setting up automatic payments can make your life easier. By automating your extra payments, you ensure that you consistently pay more without even thinking about it. This way, you won’t forget or be tempted to spend the money elsewhere.

Remember, every little bit helps! Even small extra payments can make a big difference in how quickly you pay off your debt. Stay motivated and keep your eye on the prize!

Cutting Unnecessary Expenses

When it comes to paying off debt, cutting back on unnecessary spending should be your first focus. Here are some simple ways to trim your expenses:

Evaluating Monthly Subscriptions

- Take a close look at your monthly subscriptions. Are you really using all of them? Services like streaming platforms, magazines, and gym memberships can add up quickly.

- Cancel any subscriptions you don’t use regularly. Even small savings can make a big difference over time.

- Consider switching to free or lower-cost alternatives for entertainment or fitness.

Reducing Utility Bills

- Lowering your utility bills is another effective way to cut expenses. Simple actions like turning off lights when not in use, unplugging devices, and using energy-efficient appliances can help.

- You can also consider negotiating with your service providers for better rates.

- Look for discounts or programs that can help lower your monthly bills.

Cooking at Home More Often

- Eating out can be a major drain on your budget. Try cooking at home more often. Not only is it usually healthier, but it’s also much cheaper.

- Plan your meals ahead of time and make a shopping list to avoid impulse buys. Remember, every dollar saved is a dollar that can go towards reducing your debt.

Cutting unnecessary expenses might seem tough at first, but keep your eyes on the prize: a debt-free life. Small sacrifices now can lead to big rewards later.

By evaluating your spending habits and making these adjustments, you can free up more money to tackle your debt. Every little bit helps, so start today!

Leveraging Technology for Debt Reduction

Using Budgeting Apps

Budgeting apps can be a real lifesaver when it comes to managing your money. They help you keep track of your spending, set savings goals, and monitor your progress. With these tools, you can see exactly where your money is going and make changes if needed. Using technology can simplify your financial life!

Setting Up Payment Reminders

Missing a payment can really set you back. By setting up payment reminders on your phone or through an app, you can ensure you never miss a due date. This simple step can help you avoid late fees and keep your credit score healthy.

Exploring Financial Education Resources

There are tons of online resources to help you understand and manage your debt better. From free financial literacy courses to blogs and forums, you can find a wealth of information to guide you. Mastering money skills can make a big difference in your journey to financial freedom.

Leveraging technology can make your debt reduction journey smoother and more efficient. Take advantage of these tools to stay organized and motivated.

| Tool Type | Examples | Benefits |

|---|---|---|

| Budgeting Apps | Mint, YNAB, PocketGuard | Track spending, set goals |

| Payment Reminder Apps | Prism, BillMinder | Avoid late fees, stay organized |

| Financial Education Sites | Khan Academy, NerdWallet | Learn money management skills |

Finding Extra Funds in Your Budget

When it comes to paying off debt, finding extra funds in your budget can make a big difference. Even small changes can add up! Here are some easy ways to discover extra cash:

Using Windfalls Wisely

Whenever you get unexpected money, like a tax refund or a bonus at work, think about putting it toward your debt. This can really speed up your repayment process. Instead of spending it on something else, use it to lower your debt balance.

Selling Unused Items

Take a look around your home. What do you no longer need or use? Selling those items can be a quick way to make some extra cash. Platforms like Facebook Marketplace or Poshmark are great for this. You might be surprised at how much you can earn!

Taking on a Side Hustle

If you have some free time, consider picking up a side job. This could be anything from dog walking to freelancing. A side hustle can help you earn extra money that you can put directly toward your debt.

Finding extra funds in your budget is all about being creative and resourceful. Every little bit helps you get closer to financial freedom!

Cutting Unnecessary Expenses

Look closely at your monthly expenses. Here are some areas to consider:

- Evaluate Monthly Subscriptions: Are you using all those streaming services? Cancel what you don’t need.

- Reduce Utility Bills: Simple actions like turning off lights can save you money.

- Cook at Home More Often: Eating out can be expensive. Cooking at home is usually cheaper and healthier.

By making these adjustments, you can free up more money to tackle your debt. Remember, it’s all about finding balance and making your money work for you!

Seeking Professional Help When Needed

Sometimes, managing debt on your own can feel overwhelming. That’s when seeking professional help can make a big difference. Getting expert advice can provide you with a clear path forward and relieve some of the stress you’re feeling.

Credit Counseling Services

Non-profit credit counselors can review your budget and debt, helping you find solutions that fit your situation. Usually, the assessment is free, and they can offer multiple options to help you move forward. This can be a great first step if you’re feeling lost.

Debt Management Plans

A debt management plan (DMP) is a structured repayment plan set up by a credit counseling agency. They negotiate with your creditors to lower interest rates and consolidate your payments into one monthly bill. This can simplify your finances and help you pay off your debt faster.

Bankruptcy as a Last Resort

If your debt is unmanageable, bankruptcy might be an option. It’s a serious step that can have long-term effects on your credit, but it can also provide a fresh start. Always consult with a professional to understand the implications and whether it’s the right choice for you.

Remember, seeking help is a sign of strength, not weakness. It’s about taking control of your financial future and finding the best path to becoming debt-free.

Staying Motivated Throughout Your Debt-Free Journey

Celebrating Small Wins

It’s super important to celebrate the little victories along your journey. Each time you pay off a debt, no matter how small, take a moment to recognize your progress. These small wins can keep you motivated and remind you that you are moving closer to your goal of financial freedom.

Joining Support Groups

Consider joining a support group or an online community. Sharing your experiences and hearing from others who are on the same journey can provide encouragement and new ideas. It’s a great way to stay motivated and feel less alone in your efforts.

Keeping Your Long-Term Goals in Mind

Always keep your long-term goals in sight. Write them down and place them somewhere visible. This constant reminder can help you stay committed to achieving financial stability.

Remember, managing and repaying your debt is a journey. Stay disciplined, celebrate your progress, and lean on your support system when needed.

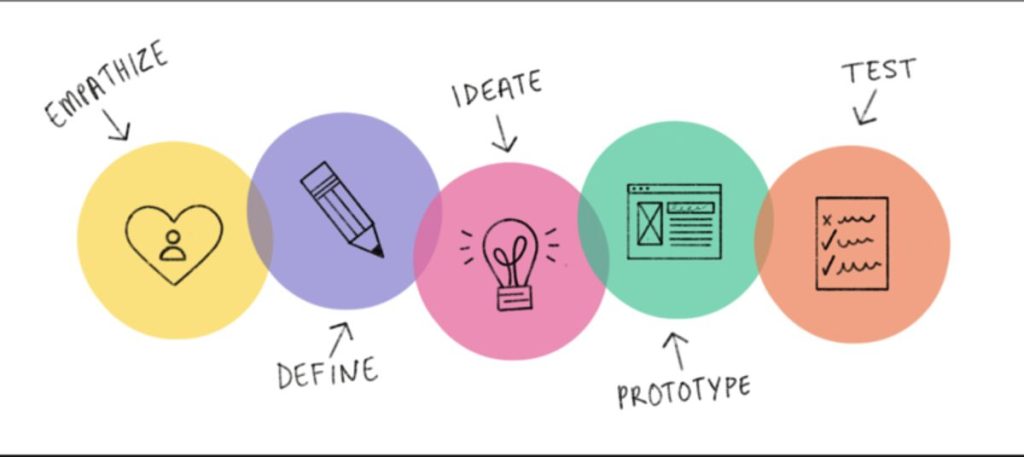

Creating a visual reminder of your financial goals, such as a vision board or a savings tracker, can help you stay motivated during these challenging times.

Exploring Debt Relief Options

If you’re feeling overwhelmed by debt, exploring debt relief options can be a smart move. Debt relief can help lighten your financial load by changing the terms of your debt or even reducing the amount you owe. Here are some common options to consider:

Debt Settlement

- This involves negotiating with your creditors to pay less than what you owe. It can be a good option if you can’t afford to pay your debts in full.

- You can try to negotiate on your own or hire a company to help you.

- Keep in mind that settling debt can impact your credit score.

Debt Management Plans (DMP)

- A DMP is set up through a credit counseling agency. They work with your creditors to lower your interest rates and consolidate your payments into one monthly bill.

- This can simplify your finances and help you pay off your debt faster.

- It’s a great option if you want to stay organized and have a clear repayment plan.

Bankruptcy as a Last Resort

- Bankruptcy can erase most unsecured debts or set you up on a repayment plan. However, it should be considered only if your debt is unmanageable.

- There are two main types: Chapter 7 (liquidation) and Chapter 13 (repayment plan).

- Always consult with a professional to understand the long-term effects on your credit and finances.

Remember, exploring debt relief options is about finding the best path to financial freedom. It’s okay to seek help and take control of your financial future.

Improving Your Credit Score While Paying Off Debt

Managing your debt is not just about paying it off; it can also help improve your credit score! Here are some simple ways to boost your credit while you work on becoming debt-free.

Understanding Credit Utilization

Credit utilization is how much of your available credit you are using. Keeping this number low is key! Aim to use less than 30% of your total credit limit. This shows lenders that you are responsible with credit.

Timely Bill Payments

Paying your bills on time is one of the most important factors in your credit score. Set reminders or automate your payments to avoid late fees. Even one late payment can hurt your score!

Monitoring Your Credit Report

Regularly check your credit report for errors. If you find mistakes, dispute them right away. Keeping your report clean can help improve your score over time.

Remember, improving your credit score is a journey. Stay focused on your goals, and celebrate your progress along the way!

Summary of Key Points

- Keep credit utilization below 30%.

- Pay bills on time to avoid penalties.

- Monitor your credit report for errors.

By following these tips, you can work towards a better credit score while paying off your debt!

Wrapping It Up: Your Path to Financial Freedom

Paying off debt might feel like a big mountain to climb, but with a solid plan, you can totally do it! Whether you go for the avalanche method to save on interest or the snowball method for quick wins, the important thing is to stay committed. Every little bit counts! By cutting back on spending, finding extra cash, and keeping your eyes on your goals, you can make a real difference. Keep pushing forward, and soon you’ll see how far you’ve come. You’ve got this!

Frequently Asked Questions

What should I do first to pay off my debt?

The first step is to know exactly how much you owe. List all your debts, including amounts and interest rates.

How can I make a budget that helps me pay off debt?

Start by tracking your income and expenses. Set clear financial goals and find ways to cut back on spending.

What is the Debt Avalanche Method?

The Debt Avalanche Method means you pay off the debt with the highest interest rate first, which saves you money in the long run.

What does the Debt Snowball Method involve?

The Debt Snowball Method focuses on paying off the smallest debts first to gain momentum and motivation.

How can I find extra money to pay off my debts?

Look for ways to cut unnecessary expenses, use any unexpected money wisely, and consider automating extra payments.

Should I think about debt consolidation?

Debt consolidation can be a good option if you have high-interest debts. It combines them into one payment, often at a lower rate.

What help is available if I can’t manage my debt?

You can seek help from credit counseling services or consider debt management plans to make repayment easier.

How can I stay motivated while paying off debt?

Celebrate small achievements, join support groups, and keep reminding yourself of your long-term financial goals.